Last Updated on January 15, 2023 by Constitutional Militia

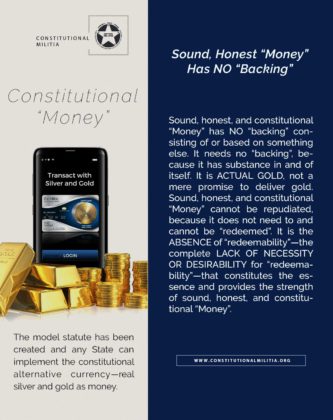

Any State can walk away from the Federal Reserve System by implementing The State Electronic Gold Currency Plan

The State of Montana has proposed legislation to implement the alternative currency system—State of Montana Alternative Currency House Bill 639

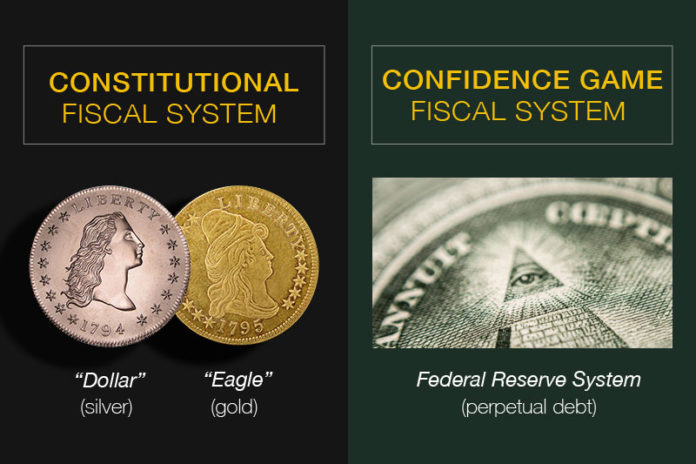

Constitutional Fiscal System vs. Confidence Game Fiscal System

Constitutional Fiscal System: Prohibited the States From Using Anything But Silver and Gold in all Governmental Fiscal Transactions and Court Decisions

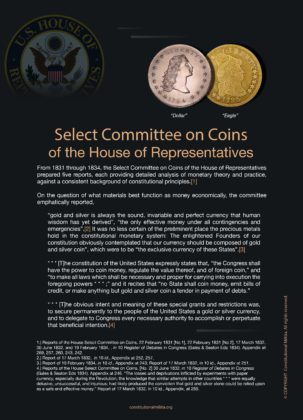

The Constitution expressly denied the States the power to make anything but silver and gold a tender in payment of debts. States are required to use silver and gold only in all governmental fiscal transactions and court decisions based on the constitutional monetary standard, the “dollar”.

The declaration—“No State shall…make any Thing but gold and silver Coin a Tender” reinforced with the declaration, “No State shall…emit Bills of Credit“, which was a term of art for “paper money”, excludes all pretension that paper money is constitutional whether redeemable in some other commodity or not.

Under a Constitutional Fiscal System “We the People” as the free market control the money supply, which is constitutionally mandated in the free coinage provision. This prevents inflationary episodes and creates a stable means of exchange and a stable economy overall.

CONFIDENCE GAME FISCAL SYSTEM: Congress, in Collusion with the Banks, has Formed a Cartel Structure over the United States Money Supply

The Federal Reserve is a “Confidence-Game Fiscal System”, because unlike the Constitutional Fiscal System, it doesn’t depend on “confidence” because there is a physical asset—each piece of money is a piece of gold and silver. One doesn’t need to have “confidence” in that, that’s what it is. What has been introduced between the governmental structure and the private economy is the “Federal Reserve System”. Congress and the Banks have removed “We the People”—the free market—and they control the money supply and thereby the entire economy.

Congress, in collusion with the banks, has formed a cartel structure over the United States money supply by “emitting bills of credit”, which is expressly forbidden by the Constitution. This “Confidence Game” Fiscal System is a scheme between Congress and the banks to loot Americans and redistribute wealth by way of a counterfeiting scheme that the average person does not understand.

John Maynard Keynes, the famous economist who fathered our present economic system, confesses (or boasts) in his book “The Economic Consequences of the Peace”, 1920: “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.”