Last Updated on January 15, 2023 by Constitutional Militia

The Civil War and “Bills of Credit”

“The immediate aftermath of the Civil War was a time of unprecedented legal flux, during which new doctrines were spun out to rationalize extreme positions adopted during the conflict. Nowhere was this more true than in the area of monetary law.”[1]

The Civil War and “Bills of Credit” (A constitutional term of art for “paper money”)

The Civil War was over two generations removed from the ratification of the Constitution. Therefore few individuals active unpolitical and legal affairs at that time could be described as “contemporaries” of the Founding Fathers or the people who ratified the Constitution, who of all Americans were best situated historically to know what that document meant.[2] For example, in one of the Supreme Court’s most important cases on the subject of unconstitutional paper currency, one Justice pointed out that,

[t]he terms, “bills of credit,” are in themselves vague and general, and, at the present day, almost dismissed from our language. It is, then, only by resorting to the nomenclature of the day of the Constitution, that we can hope to get at the idea which the framers * * * attached to it.[3]

Perhaps amazingly, this observation was offered in 1830, a scant forty-two years after ratification of the Constitution, when men who had been young adults in 1788 were still alive and capable of remembering not only “the nomenclature of th[at] day” but also the actual “bills of credit”—such as the Continental Currency—which had then circulated throughout America. And, these possible witnesses aside, the pre-constitutional historical record more than adequately addressed the issue.[4]

The Civil War witnessed numerous innovations in government driven by the crisis of secession and insurrection, including the first national suspension of the writ of habeus corpus,[5] the first income tax levied by the United States,[6] and the first irredeemable legal-tender Treasury Notes (the so-called “Greenbacks” emitted by the United States).[7]

The immediate aftermath of the Civil War was a time of unprecedented legal flux, during which new doctrines were spun out to rationalize extreme positions adopted during the conflict. Nowhere was this more true than in the area of monetary law.[8] Chief Justice Salmon Chase was the very man who as Secretary of the Treasury had lobbied for for the legal-tender United States Notes, and who Abraham Lincoln had appointed to the Supreme Court to uphold the notes’ constitutionality.[9] But even he contritely conceded in Hepburn v. Griswold,[10] the Supreme Court’s first decision on the unconstitutionality of the Greenbacks, that

“amid the tumult of the late civil war, and under the influence of apprehensions for the safety of the Republic almost universal, different views never before entertained by American statesmen or jurists, were adopted by many. The time was not favorable to considerate reflection upon the constitutional limits of legislative or executive authority. * * * Many who doubted yielded their doubts; many who did not doubt were silent.”[11]

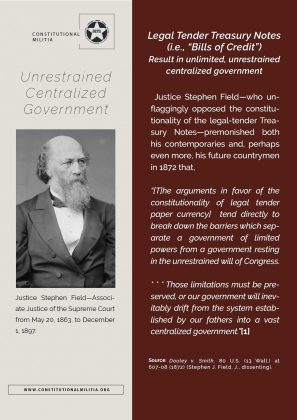

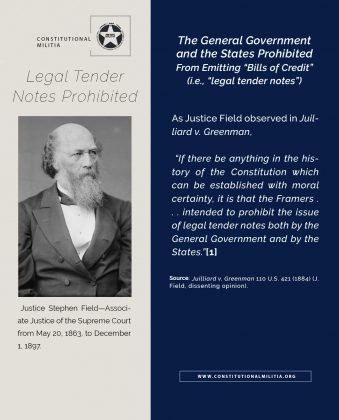

And shortly thereafter, in the case of Dooley v. Smith[12] Justice Stephen Field (who unflaggingly opposed the constitutionality of the legal-tender Treasury Notes) premonished both his contemporaries and, perhaps even more, his future countrymen that,

“the doctrines advanced in [Knox v. Lee, which reversed Hepburn and upheld the emission of the Greenbacks,] are not only in conflict with the teachings of all the statesmen and jurists of the country up to a recent period, and at variance with the uniform practice of the government for nearly three-quarters of a century, but * * * tend directly to break down the barriers which separate a government of limited powers from a government resting in the unrestrained will of Congress.

* * * Those limitations must be preserved, or our government will inevitably drift from the system established by our fathers into a vast centralized and consolidated government.”[13]

Predictably, the Greenbacks soon significantly depreciated against gold: At the end of 1862, 1863, and 1864 $100 in gold exchanged for $128, $148, and $225 in paper respectively—the low point being July of 1864, when $100 in gold exchanged for $285 in Greenbacks.[14]

It’s important to note when these “bills of credit” came out—in the course of a major political crisis—The Civil War, which to the Political Class rationalizes the use of “emergency powers”. This is still the argument that is always made—“There is an emergency, so we have to do “X”, otherwise something terrible will happen”—people panic, politicians panic, and the next thing you know this “precedent” is on the books. In fact, this was the argument that was made for the emission of the Lincoln Greenbacks.