Last Updated on January 15, 2023 by Constitutional Militia

“Bills of Credit”: Outlawed by the Constitution

In the the Federal Convention of 1787, the initial draft of the Constitution reported by the Committee of Detail copied the relevant language of the Articles [of Confederation] almost word for word: “To borrow money and emit bills on the credit of the United States”.[1] But, by a vote of nine States to two, the the Convention deleted the phrase “and emit bills”.[2]

“Bills of Credit”: A Term of Art for Paper Money in the Pre-Constitutional Period

America’s Founding Fathers, realists all, denominated redeemable paper currency as “bills of credit”. They knew that such bills’ values in gold or silver are always contingent upon the issuers’ credit—that is, ultimately, the issuers’ honesty and ability to manage their financial affairs. The unavoidable trouble with “bills of credit”, though, is that they can (and usually do) turn out to be “bills of discredit”, when the holders discover that the money-managers are dishonest and incompetent—or worse, as is the situation today, highly competent at dishonesty. Then the holders of the paper currency (if they are sufficiently astute) realize how unwise it is to allow the gold to remain in the custody of the very institutions and individuals with the greatest incentives, and the uniquely favorable positions and opportunities, to steal it.[3]

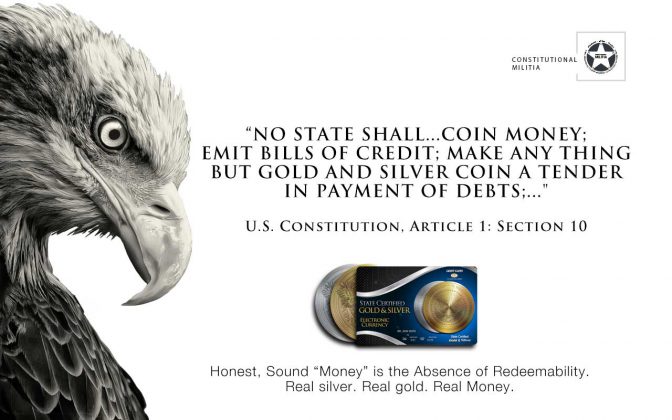

In the the Federal Convention of 1787 , the initial draft of the Constitution reported by the Committee of Detail copied the relevant language of the Articles [of Confederation] almost word for word: “To borrow money and emit bills on the credit of the United States”.[4] But, by a vote of Nine States to two, the the Convention deleted the phrase “and emit bills”.[5] Subsequently the Constitution was and remains as a declaration of constitutional law, “No State shall…; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts….”[6] States are disabled from “emit[ting] bills of credit” whether redeemable in some other commodity or not. Concurrently States are required to transact in silver and gold only, based on the constitutional standard, the “dollar”, as used in the Constitution,[7] a coin containing precisely 371-¼ grains of fine silver. Turning our attention to Congress, we need to recall that Congress only has the powers that are granted to it. We do not look in the Constitution for prohibitions on Congress’s authority and assume that it can do everything that is not prohibited. You look for delegations of authority, and anything that has not been delegated is prohibited. Inclusio unius exclusio alterius.[8]

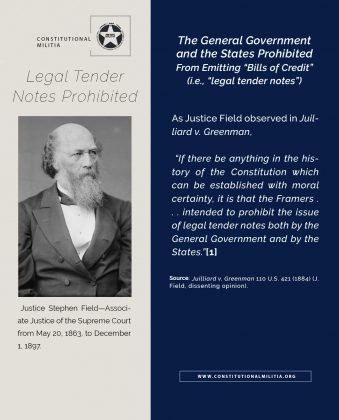

Because uncertainty, confusion, and downright error in terms of definitions can all too easily insinuate themselves into shoddy constitutional analysis, we must conduct any examination of the Constitution’s terms circumspectly. For example, in one of the Supreme Court’s most important cases on the subject of unconstitutional paper currency, one Justice pointed out that,

“[t]he terms, “bills of credit,” are in themselves vague and general, and, at the present day, almost dismissed from our language. It is, then, only by resorting to the nomenclature of the day of the Constitution, that we can hope to get at the idea which the framers * * * attached to it.”[9]

Amazingly, this observation was offered a scant forty-two years after ratification of the Constitution, when men who had been young adults in 1788 were still alive and capable of remembering not only “the nomenclature of th[at] day” but also the actual “bills of credit”—such as the Continental Currency—which had then circulated throughout America. And, these possible witnesses aside, the pre-constitutional historical record more than adequately addressed the issue.[10]

The declaration—”No State shall…emit Bills of Credit”— Article I, Section 10, Clause 1—whether redeemable in some other commodity or not—excludes all pretension that paper money is constitutional.

The “bill of credit” (i.e., paper money) mechanism is one that is infinitely expandable. In the “old days” it was restricted by how much paper you had to print the bills and how fast someone could sign them. Today, the process is electronic and not bound by paper limitations. It’s all electrons, so counterfeiters can generate as much “money” as they want. This is an open invitation to counterfeiting, fraud, redistribution of wealth, and looting.

As Justice Stephen Field recognized, “For nearly three-quarters of a century after the adoption of the constitution, and until the legislation during the recent civil war, no jurist and no statesman of any position in the country ever pretended that a power to impart the quality of legal tender to its notes was vested in the general government There is no recorded word of even one in favor of its possessing the power. All conceded, as an axiom of constitutional law, that the power did not exist.”[11]