Last Updated on September 2, 2022 by Constitutional Militia

Alexander Hamilton’s Mint Report (1791)

In his Report, Hamilton urged Congress to adopt silver and gold as the nation’s monetary substances, at an exchange ratio representing the proportionate value between the metals in the domestic free market. And that Congress should continue on “the track marked out” under the Articles of Confederation and the Constitution by employing the “dollar” as the monetary unit—a new silver coin derived directly from the Spanish milled dollar (or “piece of eight”) and a new gold coin containing a “dollar’s”-worth of that metal.

Alexander Hamilton’s Report on the Subject of a Mint 1791

On 28 January 1791, Secretary of the Treasury Alexander Hamilton presented to Congress his Report on the Subject of a Mint.[1] “A plan for an establishment of this nature”, he wrote, “involves a great variety of considerations—intricate, nice, and important.”[2] Indeed, the erection of a national mint was essential to the integrity of the coinage that Congress would soon mandate:

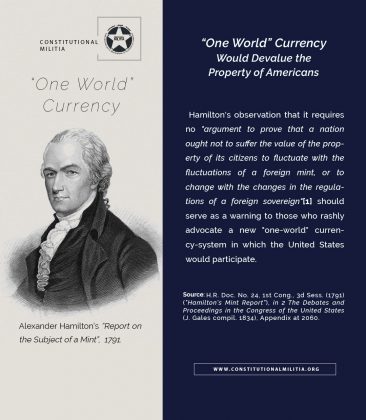

The dollar originally contemplated in the money transactions of this country [I.e., the silver Spanish milled dollar], by successive diminutions of its weight and fineness [in the Spanish mints], has sustained a depreciation of five percent, and yet the new dollar has currency in all payments in place of the old, with scarcely any attention to the difference between them. The operation of this in depreciating the value of property depending on past contracts, and * * * of all other property, is apparent. Nor can it require argument to prove that a nation ought not to suffer the value of the property of its citizens to fluctuate with the fluctuations of a foreign mint, and to change with the changes in the regulations of a foreign sovereign. This, nevertheless, is the condition of one which, having no coins of its own, adopts with implicit confidence those of other countries.

The unequal values allowed in different parts of the Union to coins of the same intrinsic worth * * * are inconveniences * * * .

It was with great reason, therefore, that the attention of Congress, under the late Confederation, was repeatedly drawn to the establishment of a mint; and it is with equal reason that the subject has been resumed * * * .[3]

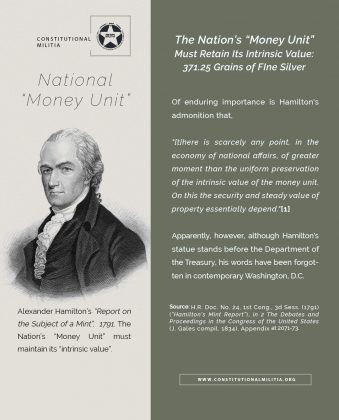

In sum, Hamilton’s Report restated the traditional monetary principles of Anglo-American common law, as Blackstone had recapitulated them, as the Continental Congress had applied them, and as the Federal Convention had embodied them in the Constitution. Congress, Hamilton urged, should adopt silver and gold as the nation’s monetary substances, at an exchange ratio representing the proportionate value between the metals in the domestic free market. Congress should continue on “the track marked out” under the Articles of Confederation and the Constitution by employing the “dollar” as the monetary unit—a new silver coin derived directly from the Spanish milled dollar (or “piece of eight”) and a new gold coin containing a “dollar’s”-worth of that metal. The government should provide free coinage of both silver and gold coins, and should preserve the intrinsic value of the coinage. Hamilton’s one innovation was his notion of a “gold dollar” which would also be the “unit”, along with the (silver) “dollar”.